how much taxes are taken out of paycheck in michigan

Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan. This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Michigan Income Tax Calculator Smartasset

Automatic deductions and filings direct deposits W-2s.

. Our calculator has recently been updated to include both the latest Federal Tax. Its important to note that there are limits to the pre-tax contribution amounts. The tax rate for 2021 is 425.

A total of 24 Michigan cities charge their own local income taxes on top of the state income tax rate. How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional. Michigan has a population of over 9 million 2019 and is widely known as the center of the United States automotive industry with the Big Three all headquartered in Detroit.

For a single filer the first 9875 you earn is taxed at 10. Federal income taxes are paid in tiers. Local income tax ranging from 1 to 24.

You would subtract 24400 from 50000 which equals 25600 in taxable income. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. For those age 50 or older the limit is 27000.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Overview of Michigan Taxes. The average amount taken out is 15 or more for.

For 2022 the limit for 401 k plans is 20500. Why Gusto Payroll and more Payroll. The American Rescue Plan Act of 2021 changed the tax code so that the first 10200 of unemployment.

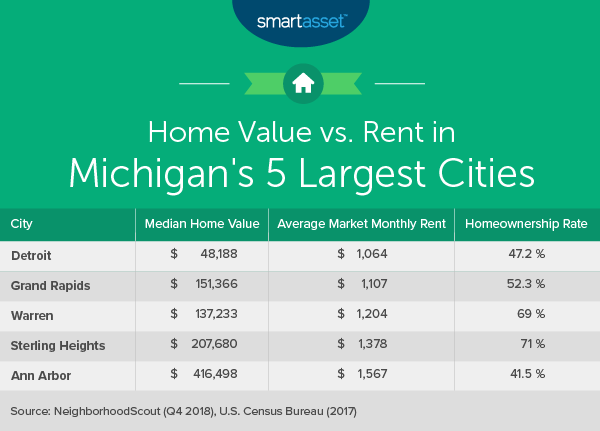

You are able to use our Michigan State Tax Calculator to calculate your total tax costs in the tax year 202122. From the chart above we can see that the. Switch to Michigan salary calculator.

Published January 21 2022. This article is part of a larger series on How to Do Payroll. Your only income is a 50000 IRA distribution.

The percentage of taxes taken out of a paycheck depends on the number of exemptions you are allowed to claim. Total income taxes paid. Some deductions from your paycheck are made.

How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our. Use this paycheck calculator to figure out your take-home pay as an hourly employee in Michigan. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

Federal tax rates like. Both employers and employees are responsible for payroll taxes. What is Michigans 2021 personal exemption amount.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. What is Michigans 2021 payroll withholding tax rate. Amount taken out of an average biweekly paycheck.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. The median household income is 54909 2017. Did The Stimulus Bill Change How Unemployment Is Taxed.

Local income tax rates top out at 240 in Detroit. The income tax is a flat rate of 425. Total income taxes paid.

We use cookies to give you the best possible experience on our. The personal exemption amount for 2021 is. For example in the tax year 2020 Social.

W4 Employee Withholding Certificate The IRS has changed the withholding rules. Michigan is a flat-tax state that levies a state income tax of 425. The federal Fair Labor Standards Act FLSA and Michigans Payment of Wages and Fringe Benefits Act PWFBA allow employers to take legally authorized and voluntarily agreed upon.

Help Michigan W 4 Tax Information

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Legislature Passes 2 5 Billion Tax Cut

Michigan Paycheck Calculator Adp

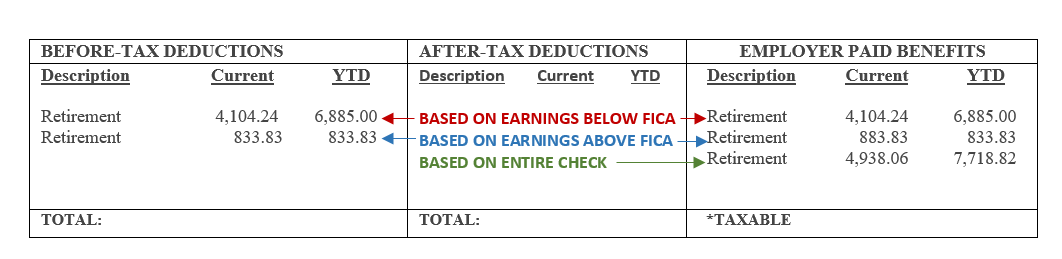

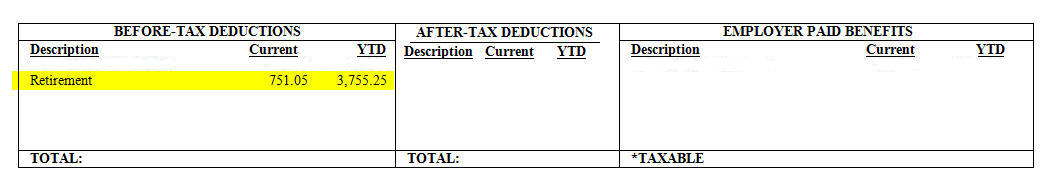

Understanding Your Paycheck Human Resources University Of Michigan

Paycheck Calculator Michigan Mi Hourly Salary

2022 Federal State Payroll Tax Rates For Employers

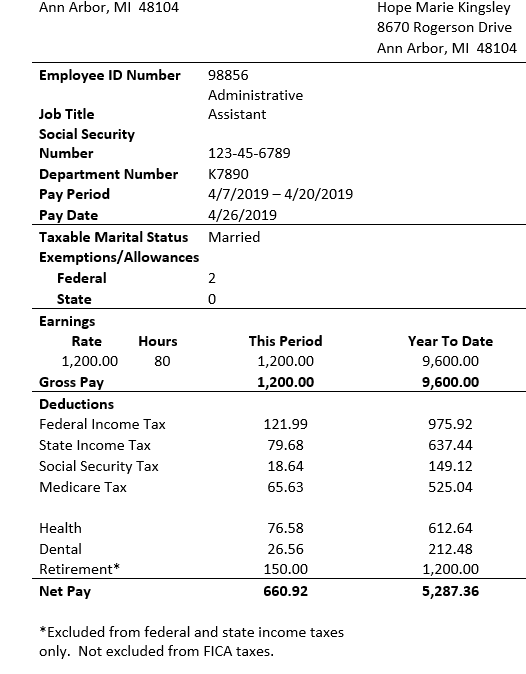

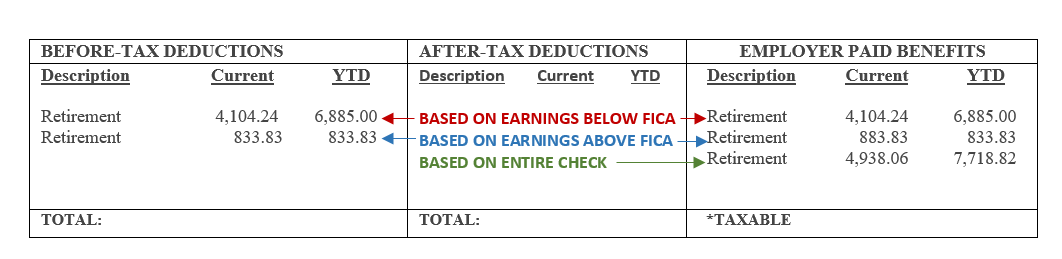

For The Federal And State Taxes The Retirement Is Chegg Com

Understanding Your Pay Statement Office Of Human Resources

Michigan Taxes On Gambling Winnings Are Due May 17 Here S What To Know

Mi Mi W4 2020 2022 Fill Out Tax Template Online

State Of Michigan Taxes H R Block

Payroll Software Solution For Michigan Small Business

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Michigan Sales Tax Calculator Reverse Sales Dremployee

The Cost Of Living In Michigan Smartasset

Michigan Paystub Generator Thepaystubs

Understanding Your Paycheck Human Resources University Of Michigan